Is Aurora Innovation a Good Autonomous Driving Stock to Buy?

Self-driving technology company Aurora Innovation (AUR) recently made its stock market debut. But is it wise to buy the stock now even though the company has not yet generated any revenues? Let’s find out.

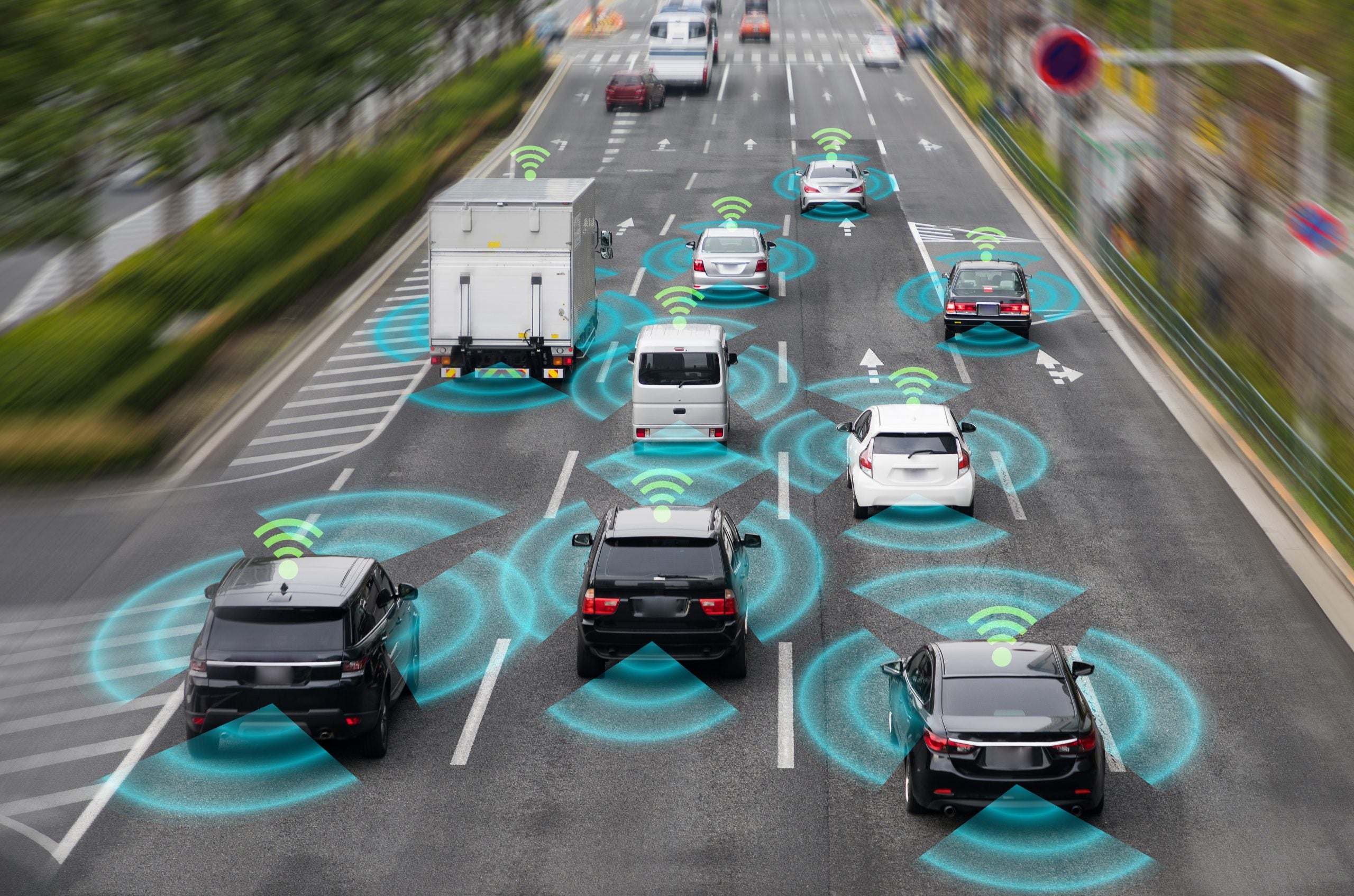

shutterstock.com – StockNews

Autonomous technology company Aurora Innovation, Inc. (AUR) in Pittsburgh, Pa., recently completed its business combination and began trading on November 4, merging with special purpose acquisition company (SPAC) Reinvent Technology Partners Y, and raising over $1.80 billion in gross proceeds. The stock has gained 6.9% in price since its public debut.

Wall Street analysts expect the stock to hit $14 in the near term, which indicates a potential 16.6% upside.

However, AUR is currently trading 32.4% below its all-time high of $17.77, which it hit on November 19, 2021. Moreover, the entire automotive industry is facing severe semiconductor chip and labor shortages, which could hamper the company’s production plans. So, AUR’s near-term prospects look uncertain.

Click here to checkout our Electric Vehicle Industry Report for 2021

Here is what could influence AUR’s performance in the upcoming months:

Retail Trader Optimism

As major car manufacturers race to develop self-driving cars, autonomous driving technology is deemed the “next big thing” in the automotive industry. AUR’s shares soared primarily on investor optimism. According to a Bloomberg report published on November 20, the stock was widely cited on social media platforms — Twitter and StockTwits.

Stretched Valuation

In terms of forward EV/S, AUR’s 275.87x is 12,977.8% higher than the 2.11x industry average. Similarly, its 54.27x forward P/S is 3,196.5% higher than the 1.65x industry average. And the stock’s 10.38x forward P/B is 246.5% higher than the 3x industry average.

POWR Ratings Don’t Indicate Enough Upside

AUR has an overall C rating, which equates to a Neutral in our POWR Ratings system. The POWR Ratings are calculated by considering 118 distinct factors, with each factor weighted to an optimal degree.

Our proprietary rating system also evaluates each stock based on eight distinct categories. AUR has a D grade for Value, which is in sync with its higher-than-industry valuation ratios.

The stock has a D grade for Quality. AUR’s trailing-12-month ROTC and ROTA are negative, compared to the 6.73% and 5.19% respective industry averages, justifying the Quality grade.

AUR is ranked #45 out of 75 stocks in the D-rated Technology – Services industry. Click here to access AUR’s ratings for Momentum, Sentiment, Stability, and Growth also.

Bottom Line

The ongoing semiconductor and labor shortage could lead to unexpected delays and hurdles in production for AUR. In addition, AUR has yet to generate revenues. So, the stock looks overvalued at its current price level, and we think it could be wise to wait for a better entry point in the stock.

How Does Aurora Innovation (AUR) Stack Up Against its Peers?

While AUR has an overall POWR Rating of C, one might want to consider investing in the following Technology – Services stocks with an A (Strong Buy) rating: NetScout Systems, Inc. (NTCT), Jabil Inc. (JBL), and Celestica, Inc. (CLS).

Click here to checkout our Electric Vehicle Industry Report for 2021

AUR shares fell $0.49 (-4.08%) in premarket trading Friday. Year-to-date, AUR has gained 20.10%, versus a 26.79% rise in the benchmark S&P 500 index during the same period.

About the Author: Nimesh Jaiswal

Nimesh Jaiswal’s fervent interest in analyzing and interpreting financial data led him to a career as a financial analyst and journalist. The importance of financial statements in driving a stock’s price is the key approach that he follows while advising investors in his articles.

More…

The post Is Aurora Innovation a Good Autonomous Driving Stock to Buy? appeared first on StockNews.com