Morgan Stanley (MS) to Pay $60M Penalty Over Data Breach

Morgan Stanley MS has agreed to pay $60 million as fine to settle a lawsuit by its customers. The lawsuit alleged that the investment bank had failed twice to correctly rescind some of its outdated information technology that exposed customers’ personal data. The news was reported by Reuters.

– Zacks

– Zacks

Per the same article, the proposed preliminary settlement of the class action was filed at a Manhattan federal court on Dec 31, 2021, on behalf of nearly 15 million customers. Nonetheless, the same needs to be approved by the U.S. District Judge Analisa Torres.

Customers lodged complaints against Morgan Stanley for its failure to retire two wealth management data centers in 2016 before the unencrypted equipment was resold to illegitimate third parties. They said that the equipment was sold when it still possessed customer data, thus, leading to their vital personal information to trot out.

They further claimed that some older servers that contained their data had gone missing after the bank moved the same in 2019 to an outside vendor. Court papers showed that Morgan Stanley recovered the servers later.

As part of the settlement, each customer can apply for an indemnification of up to $10,000 in out-of-pocket losses. Additionally, they will receive at least two years of fraud insurance coverage.

While Morgan Stanley has agreed to resolve the case via a settlement, the investment bank reportedly denied any wrongdoing. In the settlement documents, it was added that MS made “substantial” upgrades to its data security practices.

In October 2020, Morgan Stanley had agreed to pay a civil fine worth $60 million to settle allegations by the U.S. Office of the Comptroller of the Currency regarding its unsafe data security practices in addition to the mentioned incidents.

Conclusion

The data-breach incidents of the bank underpin a potential for reputational damage to Morgan Stanley, which is one of the world-renowned investment banks. The bank operates in a business and regulatory environment that is complex, uncertain and subject to change. Also, MS is subject to numerous regulations by the U.S. regulators that add complexity to the ongoing global-compliance operations.

The ongoing charges will undoubtedly dent Morgan Stanley’s goodwill in the global arena. Nevertheless, resolution of such issues will likely restore investors’ confidence in the stock.

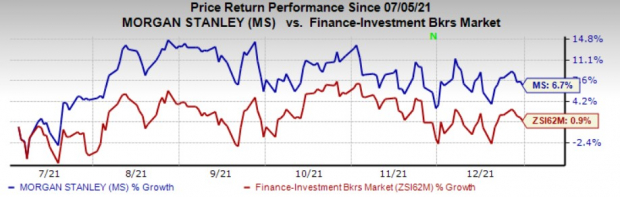

Shares of Morgan Stanley have gained 6.7% over the past six months compared with 0.9% growth of the industry.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Currently, MS carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Several finance companies continue to encounter legal hassles and are charged with huge sums of money for business malpractices. Some such names are Franklin Resources, Inc. BEN, Washington Federal WAFD and Charles Schwab SCHW.

In November 2021, a lawsuit was filed against Franklin Resources by a group of investors claiming that BEN sabotaged a startup named Onsa to get its technology and an entry into the flourishing fintech market. The news was reported by Bloomberg.

Per the lawsuit, Franklin took control of Onsa through an investment. However, while Onsa had been assured that it would remain an independent company, Franklin misappropriated its technology and liquidated assets in a “pseudo-bankruptcy proceeding” that was developed to shield itself from the liabilities to non-Franklin shareholders.

Washington Federal agreed to pay a civil money penalty of $2.5 million to the Office of the Comptroller of the Currency (OCC) in relation to its February 2018 Consent Order for Anti-Money Laundering and Bank Secrecy Act (“AML/BSA”) deficiencies.

In April 2017, Washington Federal entered into an agreement to acquire Anchor Bancorp in an all-stock transaction. That year, in September, the companies amended the merger’s termination date from Dec 31, 2017, to Jun 30, 2018, because of the identification of some faults with respect to procedures, systems and processes of Washington Federal’s BSA program. However, the deal was terminated on Jul 17, 2018.

SCHW was slapped with a class-action lawsuit over violations of its fiduciary duty by placing its interest before the protection of its clients through the bank’s robo-adviser Schwab Intelligent Portfolios’ cash-sweep program.

The case, filed in the U.S. District Court in Northern California, also accused Charles Schwab of breach of contract and the infringement of state laws.

Zacks Top 10 Stocks for 2022

In addition to the investment ideas discussed above, would you like to know about our 10 top picks for the entirety of 2022?

From inception in 2012 through November, the Zacks Top 10 Stocks gained an impressive +962.5% versus the S&P 500’s +329.4%. Now our Director of Research is combing through 4,000 companies covered by the Zacks Rank to handpick the best 10 tickers to buy and hold. Don’t miss your chance to get in on these stocks when they’re released on January 3.

Be First To New Top 10 Stocks >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Morgan Stanley (MS): Free Stock Analysis Report

Franklin Resources, Inc. (BEN): Free Stock Analysis Report

The Charles Schwab Corporation (SCHW): Free Stock Analysis Report

Washington Federal, Inc. (WAFD): Free Stock Analysis Report

To read this article on Zacks.com click here.