Reasons to Add Alliant Energy (LNT) to Your Portfolio Now

This story originally appeared on Zacks

This story originally appeared on Zacks

Alliant Energy Corporation’s LNT regular investments to add clean power generation assets to its generation portfolio and upgrade the existing network along with strong liquidity make it a solid choice for investment in the utility space.

Let’s focus on the factors that make this currently Zacks Rank #2 (Buy) stock a strong investment pick at the moment. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

– Zacks

– Zacks

Growth Projection & Surprise History

The Zacks Consensus Estimate for 2022 earnings per share has moved up 1.9% in the past 60 days.

Alliant Energy’s long-term (three to five years) earnings growth is projected at 6.06%.

LNT delivered an earnings surprise of 4.41% in the last four quarters, on average.

Return on Equity

Return on Equity (ROE) indicates how efficiently Alliant Energy is utilizing its shareholders’ funds to generate returns. At present, LNT’s ROE is 11.01%, higher than the industry average of 8.02%.

Dividend Yield

Currently, Alliant Energy has a dividend yield of 2.62% compared with the Zacks S&P 500 composite’s 1.30%. LNT has a long-term dividend payout target of 60-70% and its board of directors approved an increase of 6% in the annual common stock dividend, taking the total to $1.71 per share for 2022. In the first nine months of 2021, it paid out $304 million as dividend, up from $281 million paid out in the year-ago period.

Regular Investments & Emission Reduction

Alliant Energy announced plans to invest substantially over the next four years in strengthening the electric and gas distribution network as well as adding natural gas and renewable assets to its generation portfolio. LNT has plans to solidify electric and natural gas distribution systems and make regular investments to reinforce its infrastructure. LNT has plans to invest $5.8 billion between 2022 and 2025.

Alliant Energy voluntarily announced retiring its existing coal-fired generation units by 2040 to lower emissions from the 2005 baseline by 50% and 100% within 2030 and 2050, respectively. Overall, Alliant Energy will replace 2 gigawatts of coal-fired generation with clean energy sources over the next few years.

Favorable Debt Position

LNT had total liquidity of $764 million (including cash and funds available in its credit facility) as of Sep 30, 2021, sufficient to meet its near-term debt obligations. Its debt to capital was 54.8% at the end of third-quarter 2021, down from the 2020-end level of 54.9%.

Alliant Energy’s times interest earned ratio at the end of third-quarter 2021 was 3.1, on par with the 2020-end level. The times interest earned ratio of more than 1 indicates that it has financial strength to meet its debt obligations in the near future.

Price Performance

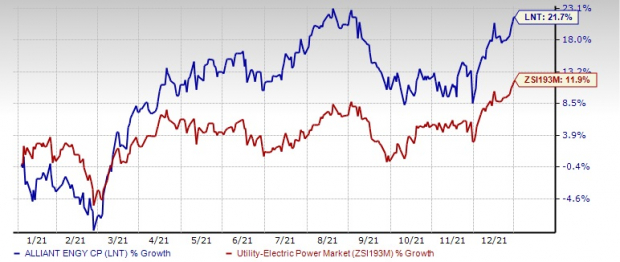

Over the past 12 months, Alliant Energy’s shares have returned 21.7% compared with the industry’s 11.9% growth.

Price Performance

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Other Stocks to Consider

Other top-ranked stocks in the same industry include IDACORP IDA, NiSource NI and Duke Energy DUK, each holding the same Zacks Rank as LNT.

IDACORP, NiSource and Duke Energy delivered an earnings surprise of 5.18%, 2.28% and 2.29%, respectively, in the last four quarters, on average.

The Zacks Consensus Estimate for 2022 earnings per share of IDA and NI has moved up 0.4% and 1.5%, respectively, in the past 60 days while that of DUK has been intact.

The long-term earnings growth rate for IDACORP, NiSource and Duke Energy is pegged at 4.44%, 6.66% and 5.29%, respectively.

Zacks Top 10 Stocks for 2022

In addition to the investment ideas discussed above, would you like to know about our 10 top picks for the entirety of 2022?

From inception in 2012 through November, the Zacks Top 10 Stocks gained an impressive +962.5% versus the S&P 500’s +329.4%. Now our Director of Research is combing through 4,000 companies covered by the Zacks Rank to handpick the best 10 tickers to buy and hold. Don’t miss your chance to get in on these stocks when they’re released on January 3.

Be First To New Top 10 Stocks >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NiSource, Inc (NI): Free Stock Analysis Report

Duke Energy Corporation (DUK): Free Stock Analysis Report

IDACORP, Inc. (IDA): Free Stock Analysis Report

Alliant Energy Corporation (LNT): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research