Zumiez (ZUMZ) Stock Rises 34

This story originally appeared on Zacks

This story originally appeared on Zacks

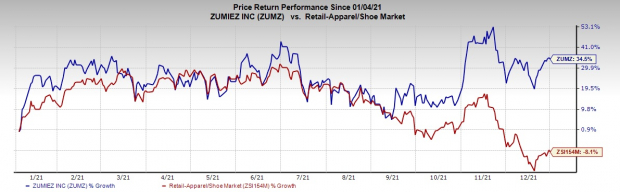

Shares of Zumiez Inc. ZUMZ have surged 34.5% in the past year, thanks to its robust business strategies and solid fundamentals. ZUMZ seems well-poised to cash in on the trends in the apparel space, backed by its one-channel concept and advanced in-store fulfillment capabilities. Its consumer-centric strategy bodes well for growth. The stock price rally of this currently Zacks Rank #1 (Strong Buy) player came against the industry’s 8.1% drop. You can see the complete list of today’s Zacks #1 Rank stocks here.

In addition, analysts look quite optimistic about this Lynnwood, WA-based retailer’s potential. The Zacks Consensus Estimate for earnings currently stands at $4.71 for fiscal 2022. This consensus mark has moved 10.6% north in the past 30 days. Also, the Zacks Consensus Estimate for Zumiez’s fiscal 2022 sales suggests growth of 1.1% from the year-ago fiscal’s reported figure.

– Zacks

– Zacks

Let’s Delve Deep

Zumiez has been effectively catering to customers’ demand via its unique merchandise offering, solid consumer services and a seamless shopping experience for a while. The implementation of advanced technology helped augment customers’ shopping experience across diverse channels. Further, ZUMZ continues boosting its competitive edge by investing in logistics, planning, allocation and omni-channel capabilities, which positions it for growth over the long haul.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

ZUMZ invested in resources to boost the localized merchandising assortments and is focused on enhancing its products. Its men’s, footwear and accessories categories are standing out. Zumiez’s one-channel approach and advanced in-store fulfillment capabilities, including Zumiez Delivery, have been paying off. Management is also on track to reduce shipping and fulfillment costs through prudent expense management.

Coming to store-expansion efforts, Zumiez remains aligned with its strategy of optimizing the store base through expansion in the underpenetrated markets while closing the underperforming outlets. Also, a major proportion of its capital spending is allocated to store remodeling and openings. In fiscal 2021, management intends to open 23 stores comprising about seven in North America, 12 in Europe and four in Australia. Simultaneously, it plans to close nearly five to six outlets in the same period.

What’s More?

Despite the aforesaid strengths, Zumiez is not immune to the pandemic-led crisis, including supply-chain headwinds, inflation, store closures and risks related to the Omicron variant. However, management is steadily making strategic moves to maneuver this tough operating landscape.

Zumiez consistently manages its inventory levels to capitalize on strong consumer demand apart from the discussed strategies above. On its last earnings call, management had stated that the inventory on hand is solid and selling at a favorable margin. Management is also working closely with the retailer’s brands and suppliers to navigate the ongoing supply-chain bottlenecks.

Wrapping up, we believe that Zumiez is well poised for delivering growth in 2022.

Other Hot Stocks in Retail

Some other top-ranked stocks are Costco COST, Tractor Supply Company TSCO and Target TGT.

Costco, a general merchandise retailer, has a Zacks Rank #2 (Buy) at present. The stock has jumped 49.3% in the past year.

The Zacks Consensus Estimate for Costco’s fiscal 2022 sales and earnings per share (EPS) suggests growth of 7.6% and 9.7%, respectively, from the year-ago period’s corresponding figures. COST has a trailing four-quarter earnings surprise of 8.3%, on average.

Tractor Supply Company, a rural lifestyle retailer in the United States, currently holds a Zacks Rank of 2. TSCO has a trailing four-quarter earnings surprise of 22.8%, on average. Shares of TSCO have surged 70.8% in the past year.

The Zacks Consensus Estimate for Tractor Supply Company’s 2022 sales suggests growth of 3.5% from the year-ago reading. TSCO has an expected EPS growth rate of 10.2% for three-five years.

Target, a renowned omni-channel retailer, presently carries a Zacks Rank #2. TGT has a trailing four-quarter earnings surprise of 19.7%, on average. The stock has rallied 30.3% in the past year.

The Zacks Consensus Estimate for Target’s fiscal 2022 sales and EPS suggests growth of 2.3% and 0.1%, respectively, from the corresponding year-ago levels. TGT has an expected EPS growth rate of 14.4% for three-five years.

Zacks Top 10 Stocks for 2022

In addition to the investment ideas discussed above, would you like to know about our 10 top picks for the entirety of 2022?

From inception in 2012 through November, the Zacks Top 10 Stocks gained an impressive +962.5% versus the S&P 500’s +329.4%. Now our Director of Research is combing through 4,000 companies covered by the Zacks Rank to handpick the best 10 tickers to buy and hold. Don’t miss your chance to get in on these stocks when they’re released on January 3.

Be First To New Top 10 Stocks >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Zumiez Inc. (ZUMZ): Free Stock Analysis Report

Target Corporation (TGT): Free Stock Analysis Report

Tractor Supply Company (TSCO): Free Stock Analysis Report

Costco Wholesale Corporation (COST): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research